Financial Ratio Flashcards, Analysis, and Accounting app for iPhone and iPad

Developer: TSAPlay, LLC

First release : 09 Nov 2015

App size: 22.07 Mb

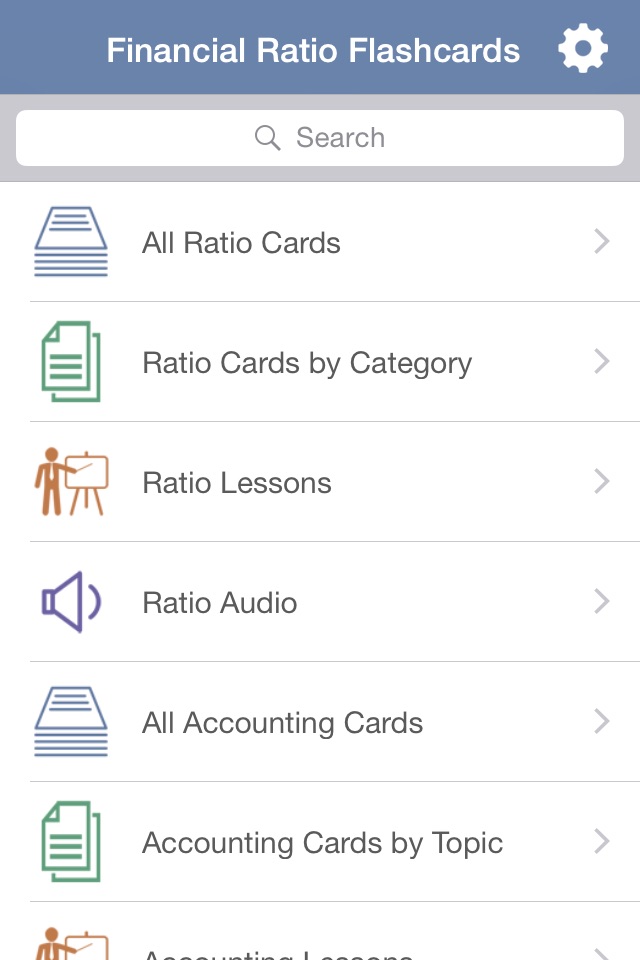

Learn about finance and accounting with over 100 flashcards coordinated with video, audio, and traditional lessons. Covering the following ratio types: liquidity, profitability, debt, solvency, operating performance, cash flow, and valuation.

All ratio cards covered: Current Ratio, Quick Ratio, Cash Ratio, Times Interest Earned Ratio, Profitability Ratios, Profit Margin Gross Margin, Effective Tax Rate, Return on Assets, Return on Equity, DuPont Formula, Return on Capital, Employed, Debt and Solvency Ratios, Introduction, Debt Ratio, Debt to Equity Ratio, Equity Ratio, Capitalization, Cash Flow to Debt, Operating Performance Ratios, Fixed Assets Turnover Ratio, Sales or Revenue per Employee, Operating Cycle, Cash Conversion Cycle, Account Receivable Turnover Ratio, Accounts Payable Turnover Ratio, Inventory Turnover, Cash Flow Ratios, Operating Cash Flow / Sales Ratio, Free Cash-Flow / Operating Cash Ratio, Cash-Flow Coverage Ratio, Price/Book Value Ratio, Earnings per Share, Price to Earnings per Share, Price/Earnings to Growth Ratio, Price/Sales Ratio, Dividend Yield Ratio, Dividend Payout Ratio, Enterprise Market Value

Aspiring financial analysts, CFAs, accountants, CPAs and MBAs can benefit from these lessons. This app will become a professional reference long after a CFA, CPA, or degree is obtained. The core content covers lessons that should be learned so that students and professionals can move into financial statement analysis.

Ratio analysis covered includes the financial statements and examples: balance sheet, income statement, and more. The illustrated accounting flashcards include balance sheet and income statement examples that coordinate with calculations. Pick and choose the premium content you want to unlock, whether it involves industry analysis, financial modeling, or financial plan.

Since accounting is a part of the finance foundation, topics such as the accounting equation, GAAP, and IFRS are also covered. This content packed app is comparable to an online course that can be used to pass the CPA, CFA, CMA, and more. Even MBA students studying finance can benefit from a solid understanding of the accounting equation and accounting basics.

Selected accounting lessons covered: Accounts, Financial Statements, Why Learn Accounting, Accounting Methods, Cash Basis, Accrual, Business Types and Sole Proprietorship, Partnerships and Flow-Through Businesses, Corporations, Small Business Structure Tips - USA, Small Business Tax Tips - USA, Intro to Financial Statements, Intro to Income Statement, Intro to Balance Sheet, Intro to Other Statements, Relationships, Preparation, and more.

Video lessons: Accounting Equation and T-Accounts, Debits & Credits diagram, Asset T-Accounts, Asset and Expense T-Accounts, Debits & Credits tutorial, Liability, Equity, Revenue, and Expense transactions, and more.

All cards accounting cards covered: Accounting equation, Accounts payable, Accounts receivable, Accounts receivable turnover, Accrued expenses, Accumulated amortization, Accumulated depreciation, Additional paid-in capital, Adjusting journal entries, Allowance for doubtful accounts, Amortization expense, Asset life, Asset retirement, Asset T-account transactions, Balance sheet, Balance sheet example, Bank reconciliation, Capital improvement, Capitalized interest, Cash basis v. Accrual, Closing retained earnings, Commercial loan, Common stock, Conservatism, Controller, Corporate characteristics, Cost of goods sold, Current assets, Current liabilities, Debits and credits system, Debt to total assets, Debt to total equity, Declining-balance depreciation, Deferred revenue, Depreciation expense, Dividends, Equity T-account transactions, Expense recognition, FIFO Inventory, Financial statement relationships, Finished goods, FOB Ship point v. FOB destination, General ledger, Gross profit, Gross profit margin, Hierarchy of GAAP, IFRS, Income statement, Intangible assets, Interest expense, Inventory, and more...